SPSS practical (SLR)

Areas Sales

1726.0 3681.0

1642.0 3895.0

2816.0 6653.0

5555.0 9543.0

1292.0 3418.0

2208.0 5563.0

1313.0 3660.0

1102.0 2694.0

3151.0 5468.0

1516.0 2898.0

5161.0 10674.0

4567.0 7585.0

5841.0 11760.0

3008.0 4085.0

· First we plot the data as scatter plot

· Then we check correlations between them

Correlations | |||

|

| area | sales |

area | Pearson Correlation | 1 | .954** |

Sig. (2-tailed) |

| .000 | |

N | 14 | 14 | |

sales | Pearson Correlation | .954** | 1 |

Sig. (2-tailed) | .000 |

| |

N | 14 | 14 | |

**. Correlation is significant at the 0.01 level (2-tailed). | |||

Correlation is sig. thus we can develop a linear between sales and area.

ANOVAb | ||||||

Model | Sum of Squares | df | Mean Square | F | Sig. | |

1 | Regression | 1.062E8 | 1 | 1.062E8 | 121.009 | .000a |

Residual | 1.053E7 | 12 | 877687.937 |

|

| |

Total | 1.167E8 | 13 |

|

|

| |

a. Predictors: (Constant), area |

|

|

|

| ||

b. Dependent Variable: sales |

|

|

|

| ||

Fitted model is sig. significant amount of the variable of the responses (sales) variable has been captured by the fitted model. Sig. amount is given by R2

· If the fitted model (SLR) is sig. does 2 parameters are significant???

NO

corr. is implies model is sig.

model is sig. implies beeta1 is sig.

model is sig. does not implies beeta0 is sig.

Coefficientsa | ||||||

Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

B | Std. Error | Beta | ||||

1 | (Constant) | 901.247 | 513.023 |

| 1.757 | .104 |

area | 1.686 | .153 | .954 | 11.000 | .000 | |

a. Dependent Variable: sales |

|

|

|

| ||

Diagnostics error

Random –DM

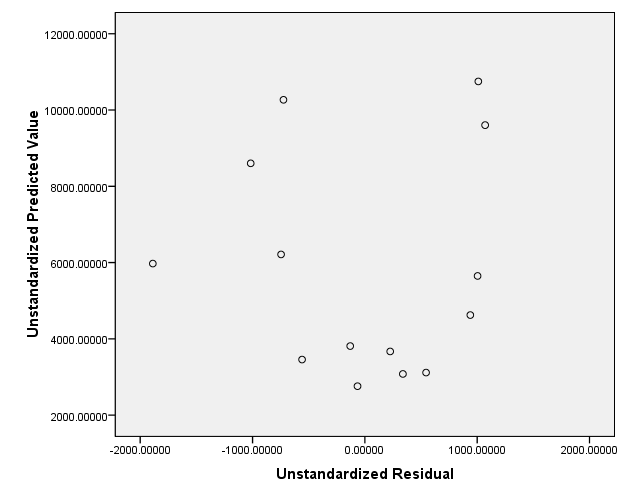

Cvonst var –plot of yhat and error

Normality

DW statistic is close zero indicating error are random

Plot res vs predict indicates random confirming error having constant variance

Normality

Tests of Normality | ||||||

| Kolmogorov-Smirnova | Shapiro-Wilk | ||||

| Statistic | df | Sig. | Statistic | df | Sig. |

Unstandardized Residual | .137 | 14 | .200* | .933 | 14 | .333 |

a. Lilliefors Significance Correction |

|

|

|

| ||

*. This is a lower bound of the true significance. |

|

|

| |||

SW test stat is not sig. calming the errors are not significant different .

Mean is not sig. diff. from as zero is in 95 % CI .

Can you accept the model??

Percentage error = res*100/obs data

Percentage error varies -46% to 16%

Percentage error varies -19% to 16% with an exceptional one as -46%

SPSS practical (MLR)

Y | X1 | X2 | X3 | X4 |

27 | 20 | 50 | 75 | 15 |

23 | 27 | 55 | 60 | 20 |

18 | 22 | 62 | 68 | 16 |

26 | 27 | 55 | 60 | 20 |

23 | 24 | 75 | 72 | 8 |

27 | 30 | 62 | 73 | 18 |

30 | 32 | 79 | 71 | 11 |

23 | 24 | 75 | 72 | 8 |

22 | 22 | 62 | 68 | 16 |

24 | 27 | 55 | 60 | 20 |

16 | 40 | 90 | 78 | 32 |

28 | 32 | 79 | 71 | 11 |

31 | 50 | 84 | 72 | 12 |

22 | 40 | 90 | 78 | 32 |

24 | 20 | 50 | 75 | 15 |

31 | 50 | 84 | 72 | 12 |

29 | 30 | 62 | 73 | 18 |

22 | 27 | 55 | 60 | 20 |

Correlations matrix among Y & explanatory variables | ||||||

|

| y | x1 | x2 | x3 | x4 |

y | Pearson Correlation | 1 | .373 | .059 | .048 | -.522* |

Sig. (2-tailed) |

| .127 | .815 | .852 | .026 | |

x1 | Pearson Correlation | .373 | 1 | .758** | .288 | .192 |

Sig. (2-tailed) | .127 |

| .000 | .247 | .444 | |

x2 | Pearson Correlation | .059 | .758** | 1 | .555* | .099 |

Sig. (2-tailed) | .815 | .000 |

| .017 | .697 | |

x3 | Pearson Correlation | .048 | .288 | .555* | 1 | .060 |

Sig. (2-tailed) | .852 | .247 | .017 |

| .813 | |

x4 | Pearson Correlation | -.522* | .192 | .099 | .060 | 1 |

Sig. (2-tailed) | .026 | .444 | .697 | .813 |

| |

*. Correlation is significant at the 0.05 level (2-tailed). |

|

| ||||

**. Correlation is significant at the 0.01 level (2-tailed). |

|

| ||||

Y is sig. corr. only with x4.

Though explanatory variables supposed to be independent, x1 & x2 as well as x2 and x3 are significant.

Coefficientsa | ||||||

Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

B | Std. Error | Beta | ||||

1 | (Constant) | 22.625 | 7.819 |

| 2.894 | .013 |

x1 | .468 | .114 | 1.024 | 4.112 | .001 | |

x2 | -.235 | .086 | -.777 | -2.747 | .017 | |

x3 | .156 | .134 | .224 | 1.166 | .265 | |

x4 | -.407 | .098 | -.656 | -4.150 | .001 | |

a. Dependent Variable: y |

|

|

|

| ||

In SLR model is sig. implies variable is sig.

But MLR model sig. does not implies all variables are sig.

Adding models increases the R2, but it does not imply all variable are sig.

Non sig. variables are known nuisance variable.

Prob: how do we decide which parameter to be included in to the model?

0 Comments